What is better than purchasing a new business van at a cheaper price? Thanks to the new super-deduction tax break, as a business owner you can a tax relief on commercial vehicles. Having a reliable fleet is essential to many industries, so if that applies to you, listen up!

Here is all you need to know about using the van relief tax.

What is the super-deduction tax break?

Naturally, since the COVID-19 pandemic, the UK has experienced low levels of business investment. As a solution, the government have introduced more generous capital allowances as a way of benefiting business owners and promoting economic growth. According to the Office for Budget Responsibility (OBR), the super-deduction will raise the level of business investment by 10 per cent, or roughly £20bn a year. The super tax relief allows businesses to make expenditure on a range of investment products including new and unused:

- Plant machinery

- Tooling

- Computer Equipment

- Furniture

- Software

- Commercial Vehicles (Vans/Lorries etc.)

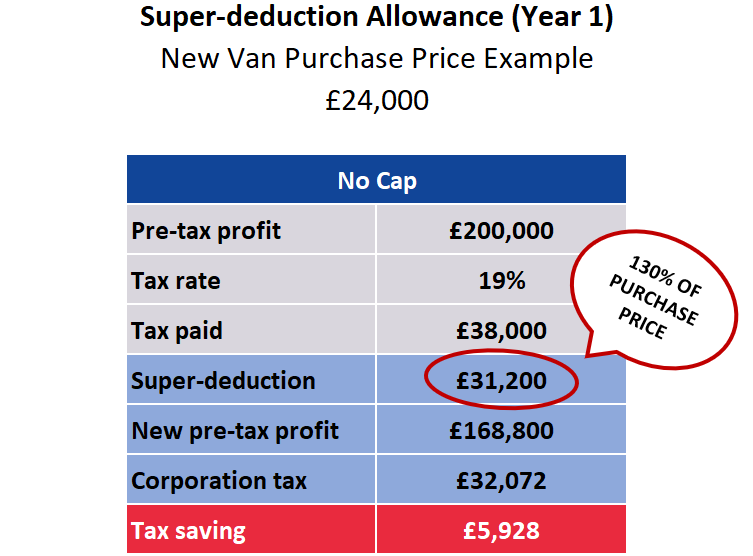

These assets are available for the 130% deduction (also known as super tax relief) and expenditure needs to be incurred on or after 1 April 2021 but before 1 April 2023. If you are a business that is looking to invest, the super-deduction tax break can provide 5p off company tax bills for every pound spent on qualifying purchases so you can get your business back off to an amazing start post-COVID and for the future.

Here’s an example of how the super-deduction tax relief could work for you.

Why is the super tax relief beneficial?

Any way that you can reduce your expenses is a great benefit to your business. With the van tax relief, you can make great investments that will help you now and in the future whatever your plans are.

The super tax relief is an option that you should consider for the following reasons:

- You can upgrade your old vans to something newer and more reliable.

- If you’re considering new services that require a fleet, the super tax relief will make that possible at a much lower rate.

- You can purchase a van that would have otherwise been out of your budget.

Are you interested in extra tax relief on new vans? At Van Sales in Bristol, we work with business owners across the country to find amazing deals on commercial vans. Our stock includes some of the best van makes and models available so you can build a high-quality fleet that is within your budget. Benefit from tax relief on commercial vehicles today. Get in touch with us for more information.

.jpg)

.png)

.jpg)

.png)

(1)-image(400x400).png)

.jpg)

.png)

.jpg)

.png)